Home >> About the Department >>Finance Department Branches >> Finance (Economic Affairs) Branch

Finance (Economic Affairs) Branch

The Department is primarily meant for effecting proper financial administration in the State. The main functions of the Department are indicated below: i. Preparation of skeleton Budget in respect of Revenue Expenditure of the State. ii. Preparation of forecast of resources. iii. Watching the flow of revenue such as release of Art. 275 grants, share of Central Taxes, on-account payment of Central Assistance for State Plan Schemes, Ways and Means Advance for Centrally Sponsored Schemes, Central Sector Schemes, NLCPR, EAP and N.E.C. Plan Schemes. iv. Watching the flow of receipts and out goings, finding out resources for the State and monitoring the reports on collection of taxes and loans. v. Watching the progress of small savings collection, claim of reimbursement from the Government of India by the Department concerned. vi. Introduction and enforcement of Economy Measures, Financial Control and Discipline. vii. Watching the share between the State Government and the District Councils on Motor Vehicles Tax/ Royalties on Minor/Major/Professional Tax etc. viii. Watching the release of certain grants by Government of India and follow up action for preferring claims by the Department, such as Border Roads, Jails, Civil Defense and Home Guards, etc. ix. Policy etc on Natural Calamities following on the recommendation of the Finance Commission and watching the release of Central share by the Government of India. x. Fixation of the rate of interest on various loans sanctioned by the State Government. xi. Matter relating to Additional Resources Mobilization. xii. Dearness Allowances etc. Financial matters. xiii. Dealing with outside file that come from Finance (EC) Department for the purpose of release of funds/additional requirements. xiv. Digital Payments &Direct Benefit Transfer (DBT) Cell. xv. Civil Deposits & Treasury Current Account xvi. ADB Project on Supporting Human Capital Development in Meghalaya. xvii. FRBM Act. xviii. Monthly Civil Accounts. xix. VDMS, IFMS, CPSMS xx. Monthly Statement and Daily Reports on Receipt & Expenditure from DAT/TOs. xxi. State Government Guarantee Ways and Means: (i) Watching and monitoring the daily cash balance position of the State Government. (ii) Monitoring the daily Advices from the ministry and Clearances memos from Reserve Bank of India on daily basis. (iii) Monitoring the report on investment of Cash Balance and Government of India Treasury Bills. (iv) Preparation of Monthly forecast on receipts and expenditure of the State Government. (v) Arranging temporary Ways and Means. Advance either from the R.B.I. or from the Government of India in the event/likelihood of shortfall of cash position of the State and regulation of overdraft. (vi) Maintenance of ledgers for all loans raised from the market Government of India, L.I.G., G.I.C, N.C.D.C., N.A.B.A.R.D. etc. and arranging for timely repayment of principal and interest with a view to avoid penal interest. (vii) Make arrangement for floatation of market loan etc (viii) Investment in Government of India securities matters connected to. (ix) Scarcity of Coins and Demonetization of Currency Action whereon. (x) Shortage of cash in the Banks, arrangement of remittances. (xi) Monthly closing balance statement from R.B.I. and the A.G. matters relating to. (xii) State Finance Secretary's Meeting convened by RBI/GOI. Matters related to Finance Commission (i) Analysis of the trends in the receipts and expenditure of the respective Departments. (ii) Follow up action on the recommendation of Finance Commission (iii) Collect and update information on various items relating to state economy including financial working of the state enterprises. (iv) Collection and compilation of data/information and preparation of forecast of receipts and expenditure and memorandum for submission to the Finance Commission. (v) State Finance Commission. Institutional Finance (i) Act as Nodal Department between the Nationalized Banks and the State Government Department in respect of any matters between the State Government and the Banking Institution. (ii) Follow-up action for the expansion of banking network in the State for the purpose of increasing credit/deposit ratio opening of bank branches at different centres of the state. (iii) Liaison with all the Banking and Financial Institutions operating in the State Monitor and watch the progress of development in the implementation of State Government's link with Bank Finance. (iv) Matters involving all District Consultative Committee, State Level Bankers Committee and all other banking/financial institutional fora. (v) Closely monitor and watch the implementation of the District Credit Plans and other bankable Scheme over and above linkages of Government sponsored schemes with bank finance for the improvement of the economic conditions of the poor people. (vi) Women Economic Empowerment through Financial Inclusion, Financial Inclusion Committee, Designing A2F Programme. (vii) PMEGP, PMMY, PMJDY, PMSBY, PMJJDY, APY, Stand Up India. (viii) Technical Committee for fixing the Scale of Finance. Monitoring And Loan Recovery Cell: (i) To take action to ensure flow of institutional credit in the State and closely monitoring the same investment in the flow of credit to the State. (ii) To interact with the Banking institution and other financial institution and to sort out problems investment in the flow of credit to the State. (iii) To monitor and watch the function and operation of Non Bank Financial Company (NBFC) in the State. (iv) Monitoring the expenditure on Non-Plan schemes. (v) Monitoring the collection of Taxes, duties under different taxation and recoveries of loan and advances and measures for improvement. (vi) Monitoring the progress of sanction for implementation of expenditure under Non Plan /Plan. (vii) Monitoring monthly, quarterly return on:

- Collection of arrears and current demand of taxes and non tax revenue.

- Collection of arrears and current demand of loans and advances.

- Data collection, compilation for incorporation in the report of the comptrollerand Auditor General of India.

- Matters connected with short term loans for agricultural inputs and recovery loans sanctioned by the State Government to Government Department/Public Undertaking etc.

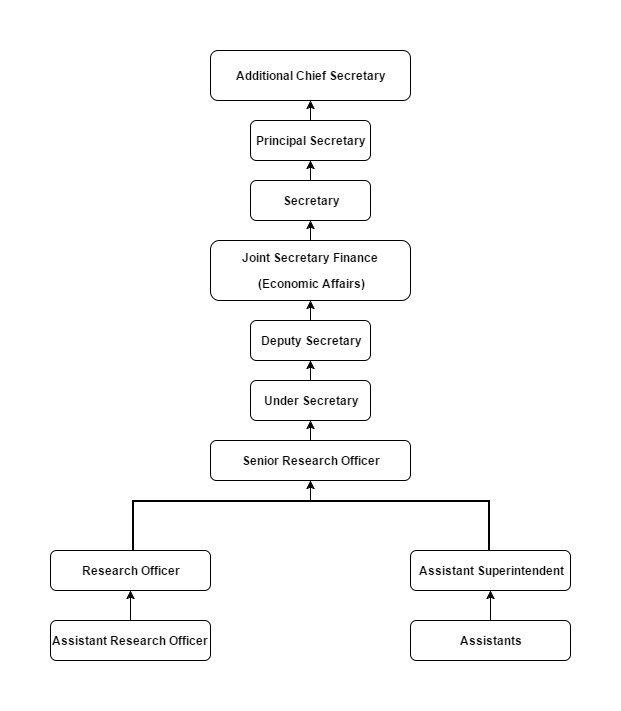

Public Enterprises Branch: (i) Monitor the functions and performance of all public enterprise establishments in the State with particular reference to the internal resources of the Public Enterprises and their contribution towards the State Plan. (ii) All matters relating to meeting etc. of the State Public Sector Undertakings, Government Agencies Companies where Finance Secretary is a Director/Member of the Board of Management. (iii) VRS to employees of SPSUs. Direct Benefit Transfer (DBT) Cell (i) To study the Schemes, classify them and re-examine existing process flows and fund flow of the same (ii) To develop Web based IT applications and facilitate automation of process flow and funds flow. (iii) To monitor and supervise the implementation of DBT on regular basis. (iv) Any other related matters. All matters received in the branch are processed by the Assistant Research Officers/ Research Officers /Senior Research Officers/Assistants and put up for decision as per the Chart below :-

Finance Economic Affairs Organisation Chart

Directory of its Officers and Employees: as on 2016-2017 (Click here)